Enter Payments from Owners

The Operating Statement Update created Accounts Receivable Invoices for Owners that were billed for Expenses. Hopefully, they will send you money after they receive their Operating Statement. This is the process for recording the payments you receive.

When Investors send you their payments for the Operating Statements you select the invoice in A/R they are paying and enter the amount of the payment. It is easier if you have a recent Accounts Receivable Inquiry Report in front of you while posting the payments.

TUTORIAL SCENARIO

We will make a payment for one of the Operating Statments you printed earlier. When the Operating Statements were Updated it created an Accounts Receivable invoice. The Invoice Number and dates will probably be different, but the principle is the same.

From the Drop Down Menu, select A/R - Invoices - Payments and JE’s.

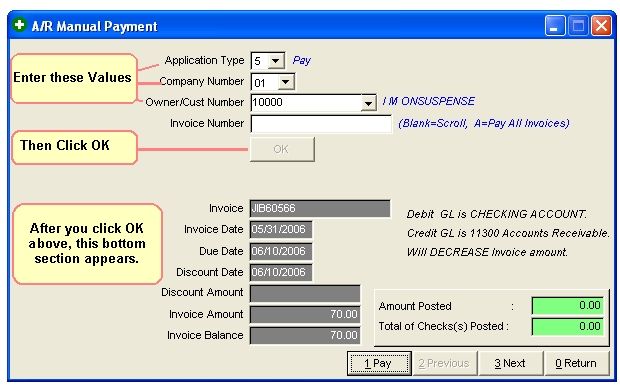

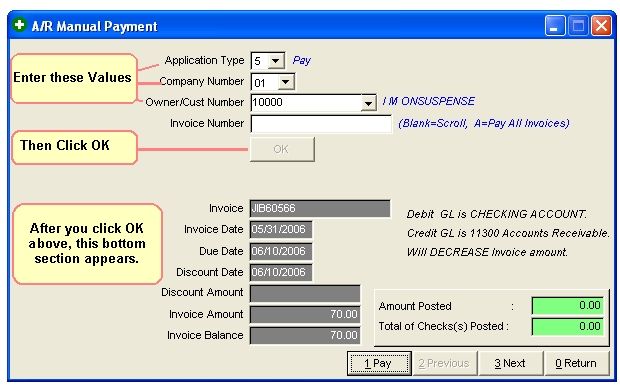

Enter 5 for Application Type, Company Number= 01, Owner/Customer Number=10000, then click OK.

The bottom section of the above image will appear.

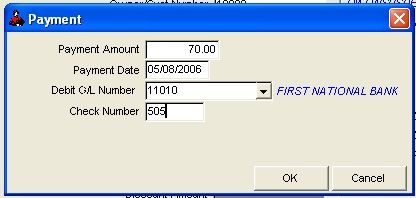

Click Pay, and the next image appears.

Complete the Payment as in above image.

Note: GL Number 11300 is hard coded for Accounts Receivable. Roughneck will make an automatic Credit to that GL Number for Payments. See GL Number Restrictions.

Click OK.

If you then click Return, you can enter a payment for another Owner. For the Tutorial, we will simply Exit.

Note on Application Type: Although we are entering a Payment, this routine also allows you to enter Journal Entry Credits(JEC), Journal Entry Debits(JED), and Discounts(DSC).

Finished!

Reports To Verify Entries

Monthly Transaction Listing - Should contain every debit and credit entered and total to zero. It should also show for each payment a credit to Accounts Receivable (G/L Number 11300) and a debit to the Cash Account you specified. Note: GL Number 11300 is hard coded for Accounts Receivable. See GL Number Restrictions.

A/R Inquiry Report - should show the payments listed below their respective Invoices. The Invoice Balance should be reduced by the amount of the payment.

Monthly Transaction Listing - should show for each payment a credit to Accounts Receivable (G/L Number 11300) and a debit to the Cash Account you specified. Note: GL Number 11300 is hard coded for Accounts Receivable. Roughneck will make an automatic Credit to that GL Number for Payments. See GL Number Restrictions.

Check Listing Report - should reflect Deposits to the cash account for payments to A/R invoices.

Related Topics

Accounting for Dummies ~ GL Number Restrictions

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.